Today, leasing is a $200 Billion + industry annually. Eight out of 10 American companies rely on leasing to acquire assets.

The ability to leverage purchasing power and take advantage of tax deductions makes leasing a viable option for physicians looking to invest in an EMR and qualify for reimbursement money under the ARRA stimulus program, or any other business improvement need.

Rather than borrow from your credit lines or liquidate investments, consider the benefits of leasing equipment or financing software and move sooner rather than later toward where your practice needs to be.

Consider this scenario: Your EMR will cost $15,000. Once implemented, your practice stands to receive $18,000 in stimulus money in the first year of use.

Meaningful Use criteria for year one attestation requires 90 days of EMR use, meaning your EMR must be operational no later than October 1st, 2012.

Allowing for implementation time of up to 90 days, you need to act sooner rather than later to make the deadline this year.

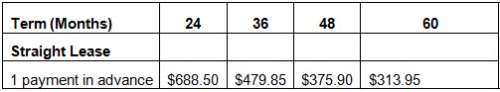

So, rather than invest $15,000 cash up front, with just one up-front monthly payment, a lease might look something like this:

Equipment/Software Cost: $15,000.00

1st year tax savings*: $2,625.00

Cost of new equipment/software: $12,375.00 (after tax savings*)

Select your preferred payment and term:

*Consult with your tax adviser.

Lisa Hartley, Vice President of Univest Capital, explains that “Most of our customers lease for one or more of these reasons. In addition, for applications of $100,000 or less, no financial information is required by our firm.”

Reason 1: CASH FLOW MANAGEMENT

Why outlay cash that you might need for something else? Financing lets you match revenue with expenses through a lease/purchase.

Reason 2: LOW MONTHLY PAYMENTS

With a financing program, payments stay the same no matter what happens to inflation over the life of your lease. Plans can be customized to meet your monthly budget so there are no surprises.

Reason 3: LEVERAGED PURCHASING POWER

Many companies make the mistake of thinking they should only acquire the equipment they can afford at a particular time. This leads to cutting corners in quality or not getting what you really need for long-term growth. By evaluating your true equipment needs, leasing will provide an effective vehicle to secure exactly what will help your business today, tomorrow and in the future.

Reason 4: PRESERVE CREDIT LINES

Quick access to leasing lets you leave your existing bank credit lines alone, making it available for potential short-term needs like marketing, payroll, inventory and supplies.

Reason 5: CONVENIENT 100% FINANCING

It is not unusual for a customer to bundle project costs into a lease. This means you can take the software you need financed, and then add any hardware, maintenance, training, installation, even the shipping, all into one payment plan. You may even finance the sales tax.

Reason 6: TAX ADVANTAGES

Some leases allow customers to treat monthly payments as a fully deductible operating expense. Your tax advisor can best help determine your eligibility for this tax benefit. Section 179 of the IRS tax code illustrates an example of this advantage.

Univest approves leases in just hours. For more information on leasing, contact Lisa Hartley at Univest Capital, Inc., 866-604-8160 ext. 127.

You must be logged in to post a comment.